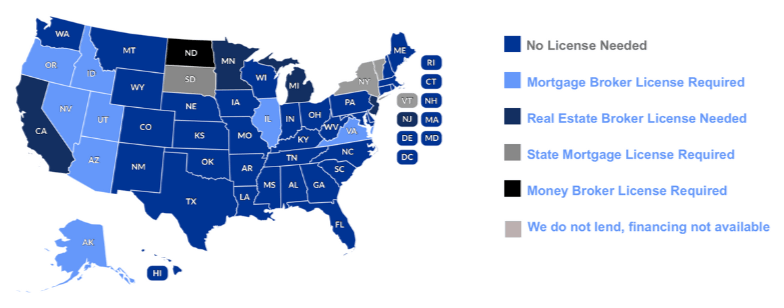

DSCR Loans: Unlocking Real Estate Opportunities in 40+ States

For real estate investors across 40+ states, finding the right financing can make all the difference between a good deal and a great one. That’s where DSCR loans come in — a powerful, flexible tool designed specifically for investors who want to scale their portfolios without the red tape of traditional mortgages.

What Is a DSCR Loan?

DSCR stands for Debt Service Coverage Ratio — a metric that measures how well a property’s rental income covers its debt obligations. Unlike conventional loans that focus on your personal income or tax returns, DSCR loans qualify based on the property’s cash flow.

In short: lenders care about whether the property pays for itself, not how much you make on paper.

Why Real Estate Investors Love DSCR Loans

-

✅ Flexible Qualification: Approval is based primarily on the property’s income potential—not your W-2s or tax returns.

-

⚡ Faster Closings: Less documentation and a simplified underwriting process mean you can close fast and stay competitive in hot markets.

-

🏘 Portfolio Growth: Because qualification is property-based, you can keep scaling—even if you already own multiple rentals.

-

🌎 Nationwide Reach: With DSCR loans available in 40+ states, you can build your portfolio where the numbers make sense, not just where you live.

How DSCR Is Calculated

Lenders determine the Debt Service Coverage Ratio by dividing the property’s Net Operating Income (NOI) by its annual debt payments.

-

A DSCR of 1.0 means the property earns just enough to cover its expenses.

-

A DSCR of 1.2 or higher shows a healthy cash flow cushion—something lenders love to see.

Every lender’s threshold varies, but the stronger the ratio, the better your terms.

Where DSCR Loans Shine

With Nexa Lending, I can help investors access DSCR loan programs in over 40 states. From short-term rentals in Florida to multi-family properties in Kentucky, or long-term rentals across growing markets like Texas, Georgia, Arizona, and Tennessee—the opportunity is wide open.

Whether you’re focused on appreciation, cash flow, or diversification, DSCR loans let you invest where the returns are strongest.

Who Should Consider a DSCR Loan?

-

First-time investors seeking simple, asset-based financing

-

Experienced landlords looking to scale quickly

-

Out-of-state buyers expanding into new markets

-

Entrepreneurs building long-term real estate wealth

Final Thoughts

DSCR loans are transforming how investors build real estate portfolios across the country. By focusing on property income instead of personal income, these loans remove traditional barriers and empower investors to grow faster—with less hassle.

If you’re ready to expand your reach, diversify your holdings, and invest with confidence, a DSCR loan might be your next power move.

Categories

Mortgage Loan Officer, Sales Associate & Veteran | License ID: NMLS 2738664

+1(727) 221-6830 | joshuabillingsfl@gmail.com